Trading based on candle colors is one of the easiest strategies you’ll come across. It’s a low risk strategy. The reason for this is that your main objective is identifying a real candle (with large body) and placing your trade based on its color.

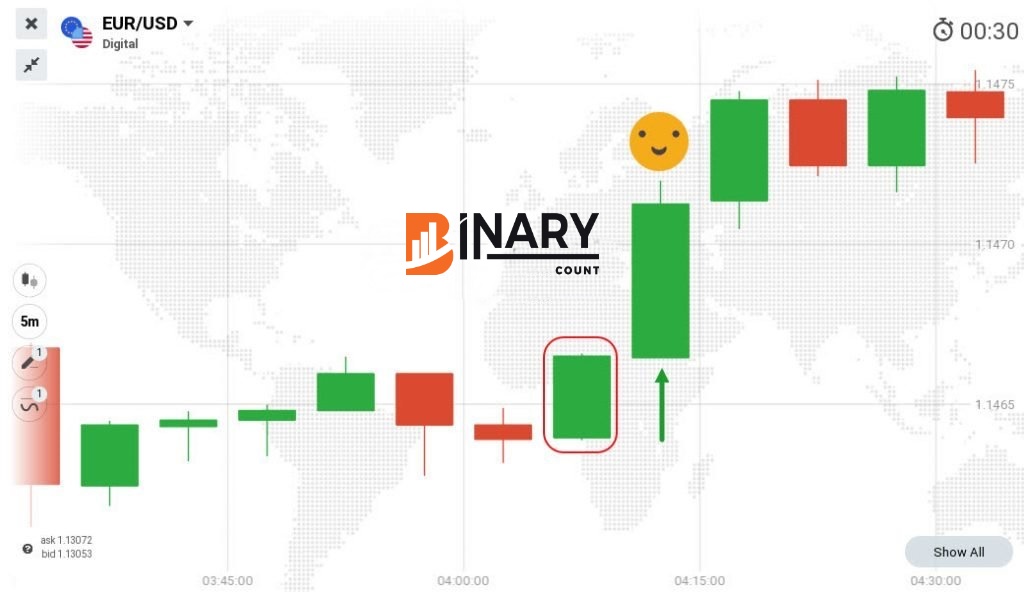

Candles with large bodies indicate strong price momentum in a specific direction. For example, a large green candle shows a strong uptrend. Therefore, placing a buy position after the green candle closes is very likely to result in a winning position.

In this guide, I’ll trade 5 minute interval candles for the EUR/USD currency pair. I’ll also use the Martingale money management strategy to ensure that each trading session ends up profitable.

Guidelines for trading candle colors on IQ Option

If you don’t know much about the Martingale system, the Is the Martingale Strategy Suitable for Money Management in Options Trading? will get you started.

I’ve also created the Ultimate Guide for Trading Candles on IQ Option to help you learn more about Best crypto platform candles on IQ Option.

But for purposes of this guide, I’ll go through the rules to follow when trading.

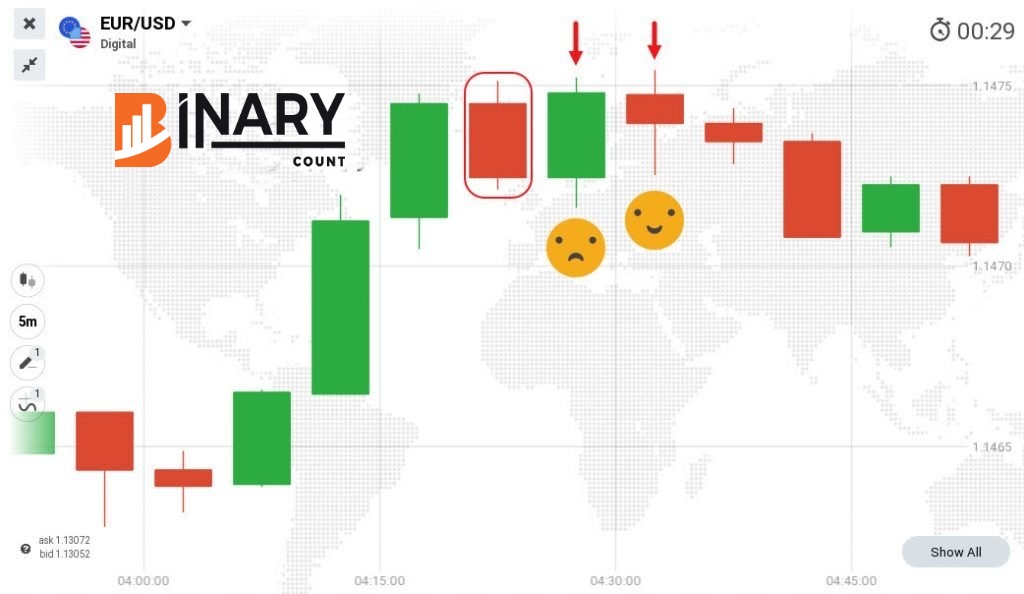

Once I identify a real candle, I’ll wait until its close. Then I’ll enter a trading position based on this candle color. For example, if I find a bearish candle, I’ll wait until it closes. I’ll immediately enter a 5 minute sell position meaning the next candle will close lower.

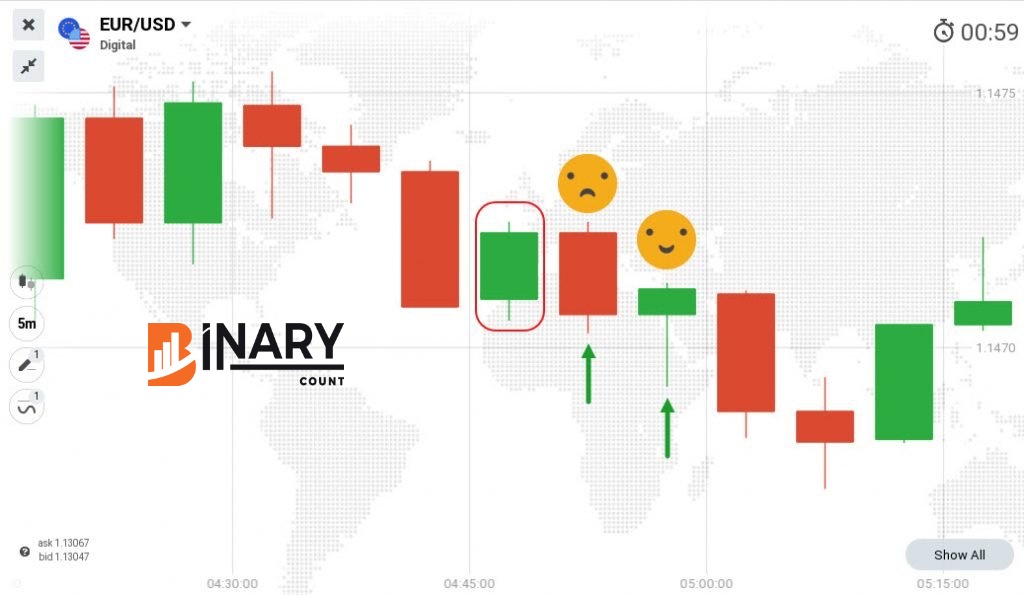

But what if the trade loses? As the candle closes, I’ll immediately enter the same position at the open of the next candle. I’ll continue doing this until I encounter a similar colored candle.

Another important rule I’ll observe is alternating between green and orange candles. If I enter a buy position that ends up profitable, my next step will be to wait until an orange candle develops. Then, I’ll enter a sell position.

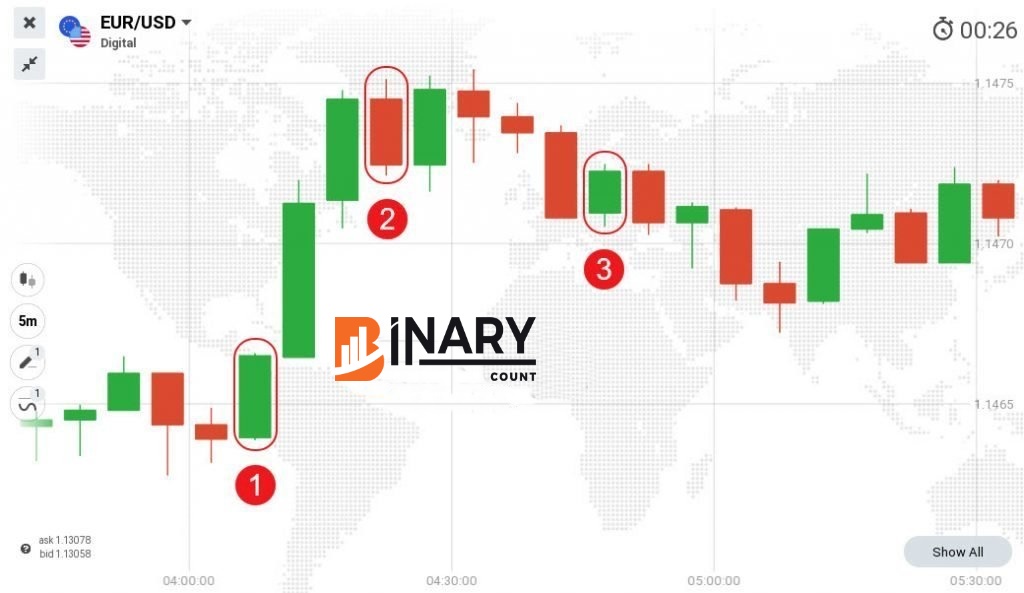

Take a look at the chart below.

How the trades went

The markets were ranging and no apparent candle was developing. However, a solid bullish candle started developing. At its close, I immediately entered a 5 minute “higher” position. This trade ended up profitable.

The second trade didn’t go as expected. The first bearish candle signaled price consolidation rather than trend reversal. The first 5 minute “lower” trade wasn’t profitable. However, I immediately entered a “lower” position at the open of the next candle. This ended up profitable.

After waiting for a bearish candle to appear, it eventually showed up. At its close, I entered a 5 minute “higher” position. This resulted in a losing position. However, I entered a similar “higher” position at the open of the next candle. This trade ended up profitable.

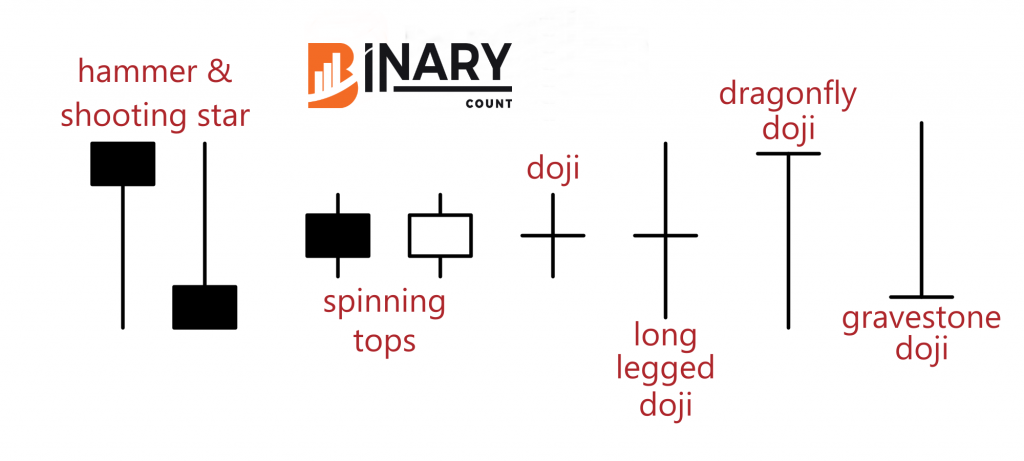

The candles to avoid when trading using this strategy on IQ Option

As mentioned, the candles to look out for are true candles. These have large bodies and small or no wicks. The types of candles to avoid are special candles. These have small or no apparent bodies as well as long wicks. Some of these are included in the image below.

All trade entry points are at the open of the next candle. The trades should last 5 minutes.

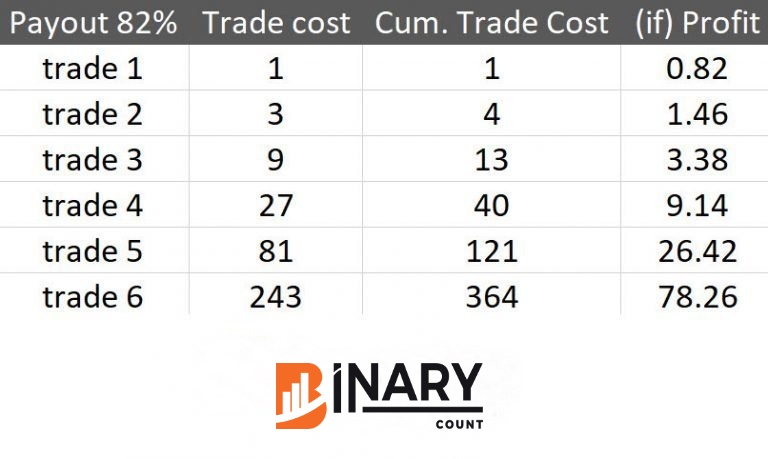

With the Martingale money management strategy, I entered 5 trades in total. 2 resulted in losses. Below is a table explaining how the Martingale system works.

Trading candles alongside the Martingale system is effective but has little returns

Since I traded 5 times, my cumulative trade cost was $121. The second and fourth trade were unprofitable meaning I lost a total of $44. The cumulative profit for the three trades was $36.42.

This means that even though I made a profit, it was quite small compared to the total amount invested.

Trading candle colors alongside the Martingale system is a simple and low risk trading strategy. However, the low risk also comes with low profits as you’ve seen.

Now that you’ve learned how this strategy works, try it out today in your IQ Option practice account.

Good luck!

No comments:

Post a Comment